Crunching the numbers: A look into how the Indiana voucher system affects public schools

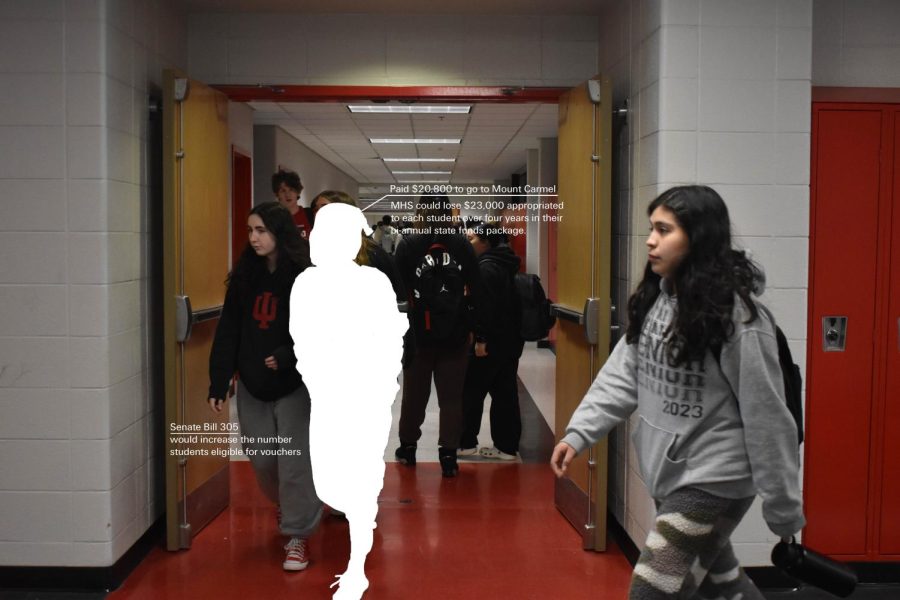

CASHING OUT Illustrating how MHS could lose money to private schools, Crier randomly selected a person to portray how anyone could use federal funding to go to a private school. If the bill was passed, the income threshold that qualifies families for the program would be raised to $200,000 a year.

March 16, 2023

Senate Bill 305, a bill that would expand funding for The Indiana Choice Scholarship Program, or school vouchers, and divert funds from public schools advanced on Wednesday. The bill would enlarge the pool of students eligible for the program and open the possibility of a voucher to almost every student in the state.

What are Vouchers?

The school choice program is a way for families to afford private schools through assistance from the state. However, that means a loss in funding for the public schools they otherwise would have attended. Senate Bill 305 proposes a raise in the income threshold that qualifies families for the program to $200,000 a year. In areas where schools struggle to meet standards, it gives families the option to find schools offering a better education that they otherwise wouldn’t be able to afford. According to Mr. Morgan Nolan, principal, schools usually receive about $5,800 per student every year. Instead of schools receiving that $5,800, that money goes directly to parents, who then put that money toward private school tuition costs.

How does this affect Munster?

Munster schools are fortunate enough to offer an education ranked 7th in the state, according to Niche, so they are not affected by vouchers as much as areas with poorer education. However, any number of students leaving the Munster school system has a large impact on school finances. Mr. Nolan says that schools budget well in advance for the year ahead, but do not receive money until Sept. 15 of that year. Meaning if a student leaves Munster for a private school before Sept. 15, the money the school counted on is no longer available. Now, a school has to dip into emergency funding. In addition, according to Assistant Superintendent Steven Tripenfeldas, any time more state money is designated for private schools, it hurts all public schools in the state.

What opportunities does the program give students using it?

For students who transfer from a public school with poor education to a private school with a better education, the biggest benefit is a quality education. It also often means smaller class sizes, a closer-knit school community and a religious education for families with religious backgrounds.

What are some of the negative impacts on students attending public schools?

According to Mr. Nolan, students who leave public schools are more academically motivated, which leaves students who perform poorly in public schools that are already struggling with academics. This creates a cycle of high-performing students leaving, which in turn brings down the overall scores of the school, in a perpetual cycle that greatly impacts both the school and the students who don’t leave.

Although the program claims to give all students the opportunity to get a quality education, that Nolan says isn’t possible in rural areas that require long travel to private schools, or families that aren’t as invested in their child’s education. Mr. Tripenfeldas says this new bill is bad public policy, and contradicts the principles of the original law. He says this new bill will disrupt the order of public education funding because instead of taking socioeconomic factors into account when deciding funding, it offers funding to families almost regardless of financial status. This will reduce revenue received from the state of Indiana, and hurt the School Town of Munster.