Uber is up. Tesla went down. I just bought Amazon. These conversations can be heard throughout the hallways of Munster High School from students who invest in stocks. For senior Kevin Martinez, his interest striked wanting to make money to build wealth. By finding companies that make money and checking on the history of a company, an investment comes in for Martinez. Technology companies are the ones that he goes for such as Google, Amazon and Microsoft.

“I think it’s important if you want to build wealth and to retire,” Martinez said. “If you want your money to work for you then I’d probably invest.”

The interest in stocks can come from not only wanting to make money, but the teachings of family members too, which was the case with senior Omar Aftab. In middle school, his father set up a custodial account and led to a fascination with the market that continues to this day.

“Sometimes people buy stocks to satiate a need for short term gain,” Aftab said. “For me, I buy value, so I don’t really find myself selling. I’m at a point in my life where I am not actively investing daily, but instead working towards building a steady portfolio that will mature into the future to begin working on a strong retirement fund. I sell if I find a stock has stagnated and reinvest, but that’s on very rare occasions.”

Many people contribute to their Social Security and 401ks as they get older to build up their retirement funds, but investing in the stock market can also help cushion one’s retirement funds.

“I choose based off of quarterly reports,” Aftab said. “Each fiscal quarter, publicly traded companies are required to drop huge documents outlining overall finances. I additionally look at the stock from a traditional value standpoint and break down its value to the average consumer. Using the methods above, along with general intuition, I’ve made my largest trades, like NVDA at 145 presplit, held until current day.”

Students in senior year participate in a stock market simulation in economics class. The game gives the chance to get insight on how the market works when purchasing different companies. Although this introduces students to the stock market, it must be their choice whether or not to continue to broaden their knowledge of the stock market.

“I’m not the biggest stock guru and I always tell students that if I could see around corners and was a giant stock wizard, I’d be on a yacht somewhere,” economics teacher Larry Dye said. “I try to point students in the right direction like starting with smaller websites or just seeking out anybody that knows a little bit more than you do.”

Recommendations from the economics teachers include researching, utilizing brokers if able, and even investing in mutual funds, but students can take it into their own hands and figure out how to invest in the market in a way that will benefit them in the long run.

“It’s good because at some point in time, you’re going to start hopefully thinking early about retirement and investing in something,” economics teacher Don Fortner said. “When you’re young you don’t think ‘I’m going to need money’ like that and when you get to that point you’re like ‘I wish I had more.’”

Taking stock

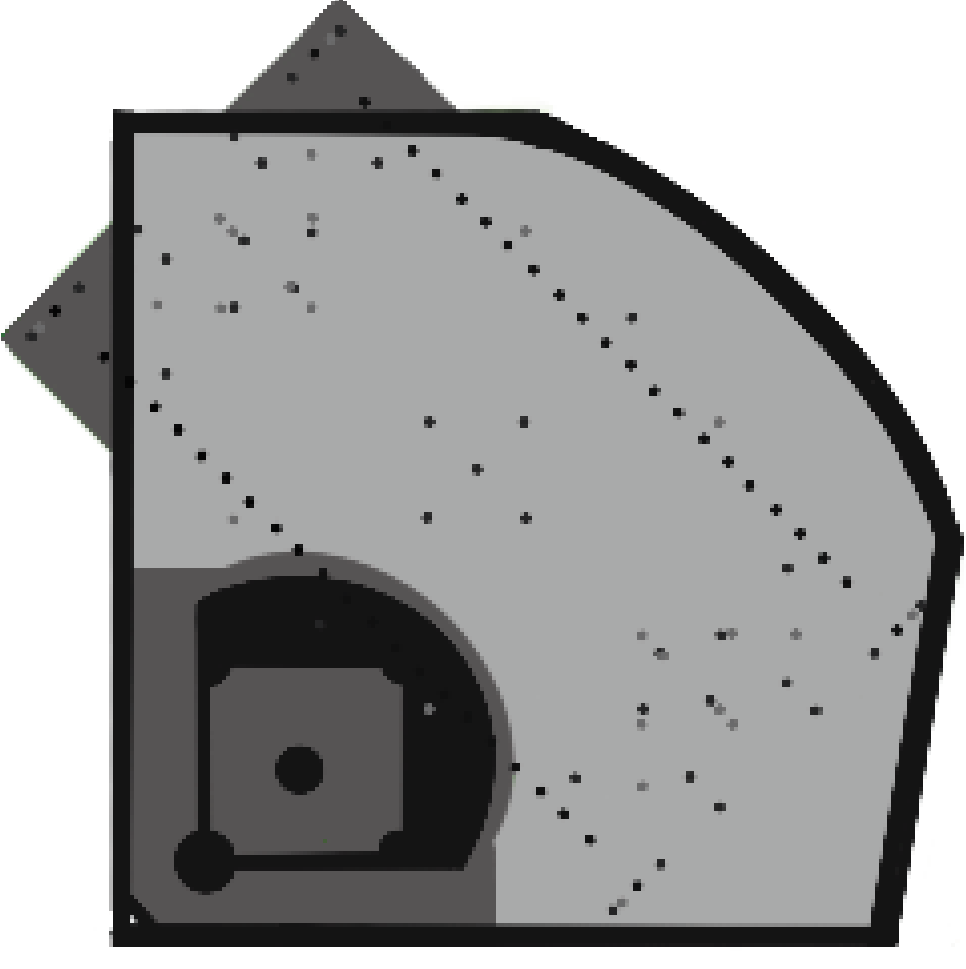

Results of a student survey email on the Stock Market of 76 students from Feb. 19-25

Do you invest in stocks?

Yes: 25%

No: 75%

Stock investors, have you taken economics?

Yes: 25%

No: 75%

How often do you involve yourself in the stocks market?

Not often: 76%

Most of the time: 20%