Column: Out of luck

December 16, 2022

I was sitting in my living room when I heard about the Biden administration canceling up to $20,000 of student loan debt. My sister had just graduated from college, and my parents were complaining that we could have paid for half of my sister’s tuition. I was mad too. We didn’t have the luxury of being secure enough in our finances to know that we could pay off those parasitic loans. I was also skeptical.

As sad as it sounds, being able to relieve millions of dollars of debt without push back from schools or legislation seemed nearly impossible. Even then, I thought the strides taken were too small—how would this help students with future loans? It also neglected to address how predatory student loans are, especially for low income students.

What I failed to recognize was how monumental this moment was in American history. Rather than giving money to large corporations, the President had given it back to everyday citizens—young adults fresh out of college who have to live below their means and parents who have taken extra shifts to avoid taking out more loans. The CARES Act did more than relieve a part of the debt—it paused payments for loans and dropped all interest rates to zero percent.

However in the past few months, federal courts have been attempting to block the loan cancellation. With the hearing being in February, I fear that, if the Supreme Court is able to strike down the Act, it will make future attempts at fixing the harmful structure of student loans a steep uphill battle. With student loans averaging at $30,000 and average fees having tripled, the system has cornered those who seek out higher education into a corner.

From Aug. to Oct., I filled out college applications alongside the rest of my peers, and I could not help but feel resentment for those who could afford to even think about early decision or Ivy league schools. Financial pressure limited my scope to only in-state schools. If I had a $20,000 cushion, I could even fully consider schools like IU Bloomington, who have better resources than the colleges I can afford. But the $20,000 will not be applied to my graduating year and beyond, so the only hope we have is reform.

Higher education should be attainable for those with lower incomes. While there are cheaper alternatives like community colleges, Ivy Leagues and private colleges allow students to network with well-established people and inherently give them a leg up in the workplace. College is not a commodity only for the rich, but everyone who wishes to put in the work to achieve it.

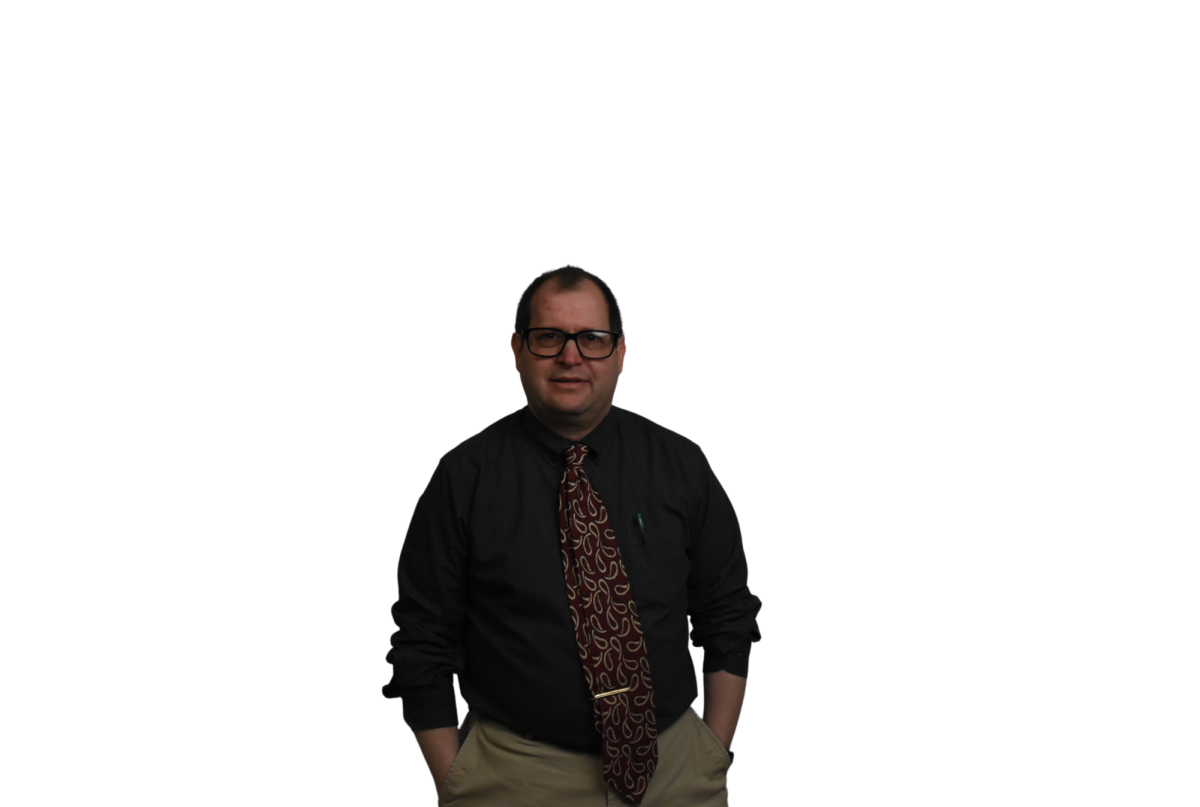

![SNAP HAPPY Recording on a GoPro for social media, senior Sam Mellon has recently started a weekly sports podcast. “[Senior] Brendan Feeney and I have been talking about doing a sports podcast forever. We love talking about sports and we just grabbed [senior] Will Hanas and went along with it,” Mellon said.](https://mhsnews.net/wp-content/uploads/2025/04/sam-892x1200.png)